The Queensland Building and Construction Commission (QBCC) is a statutory body that regulate the building industry in Queensland, established under the QBCC Act (Queensland Building and Construction Commission Act 1991). Their role is to protect, educate and support the QLD building and construction community and industry.

The QBCC requires companies and individuals (sole traders, partners and trustees) to hold a QBCC licence to carry out or contract for works that are:

- Valued at over $3,300

- Valued at over $1,100 when involving Hydraulic Services Design

- Any value that involves gas fitting, drainage, plumbing, termite management (chemical), protection from fire, site classification, mechanical services, building design or residential building inspections on completed works.

Licences vary in class for the scope of works to be undertaken and the type of role/responsibility that you have in the industry. Depending on the works that you are undertaking, you or your business may require more than one licence class to cover job scope.

The QBCC requires that licence holding businesses lodge their annual financial information by set reporting dates each year. Annual reporting has been designed to ensure that all licence holders are compliant with regulatory financial requirements. You can learn more about the QBCC’s financial reporting requirements here: https://www.qbcc.qld.gov.au/running-business/financial-requirements/financial-reporting-obligations-contractor-licensees/annual

The next set of reports for SC1 and SC2 licence holders are due by the 31st of March, 2023. These were available to lodge from the 1st of November last year. For Categories 1-7 lodging commenced on the 1st of August 2022 and was due by the 31st of December 2022. Fines may apply if the submission deadline isn’t met.

If you would like assistance completing your annual reporting, MB Accounting are here to help. Before we can be of assistance, an accountant needs to be added to your myQBCC Portal. How can you do this? We’ve put together a step by step guide below that’ll demonstrate how to add us to your myQBCC portal – once this is complete we’ll be able to compete your annual reporting submissions in the future to save you the hassle.

Step 1:

Log on to the myQBCC portal:

https://my.qbcc.qld.gov.au/s/login/

Step 2:

Find the ‘My Licences’ tab and click on it. This will display your licence information, including expiry dates and renewal dates.

Step 3:

Click on the dropdown arrow on the right-hand side of the page next to the ‘Action’ tab. This will show you several options. Select the ‘Manage Representatives’ option.

Step 4:

Click ‘Add new representative’ and enter the details of MB Accounting & Business Services and/or any other accounts that you need to add. Please note that you can add multiple accountants if needed.

Step 5:

Once you have entered the required accountant details, select ‘Manage Permissions’. Scroll down to ‘Licensing Management’ and click the ‘Enable’ button next to ‘Submit Annual Financial Report’. This will give us permission to lodge your annual QBCC reporting for you.

Within the myQBCC portal you have the option to lodge your annual reporting yourself. Part of the reporting required includes financial data including your current ratio and net tangible assets. MB Accounting can assist with calculating this information for you.

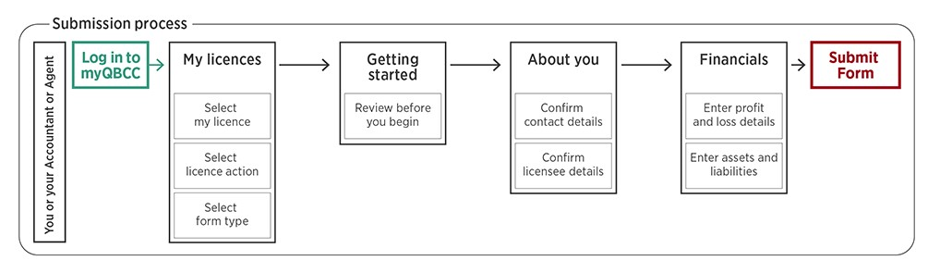

To lodge your annual QBCC reporting, you can follow the steps below:

MB Accounting and QBCC reporting

Here at MB Accounting we have QBCC experts who specialise in assisting building and construction businesses. We can help with your annual QBCC reporting as well as the QBCC’s Minimum Financial Requirements (MFR) reporting.

Contact MB Accounting today to have a chat about how we can help you.